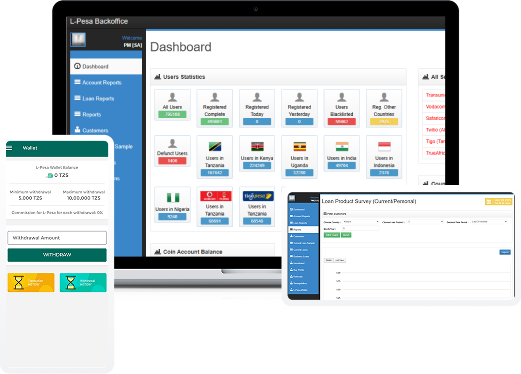

Regional Integration, Automation & Accessibility

To bring L-Pesa's vision to life, Codelogicx implemented a multi-phase strategy that aligned with regional nuances, platform scalability, and responsible lending goals. Our focus on country-specific API integrations facilitated seamless partnership between L-Pesa and local mobile money providers. Thus, frictionless financial transactions were possible in remote ecosystems.

Here's How We Laid the Groundwork for Scalable, Inclusive Finance

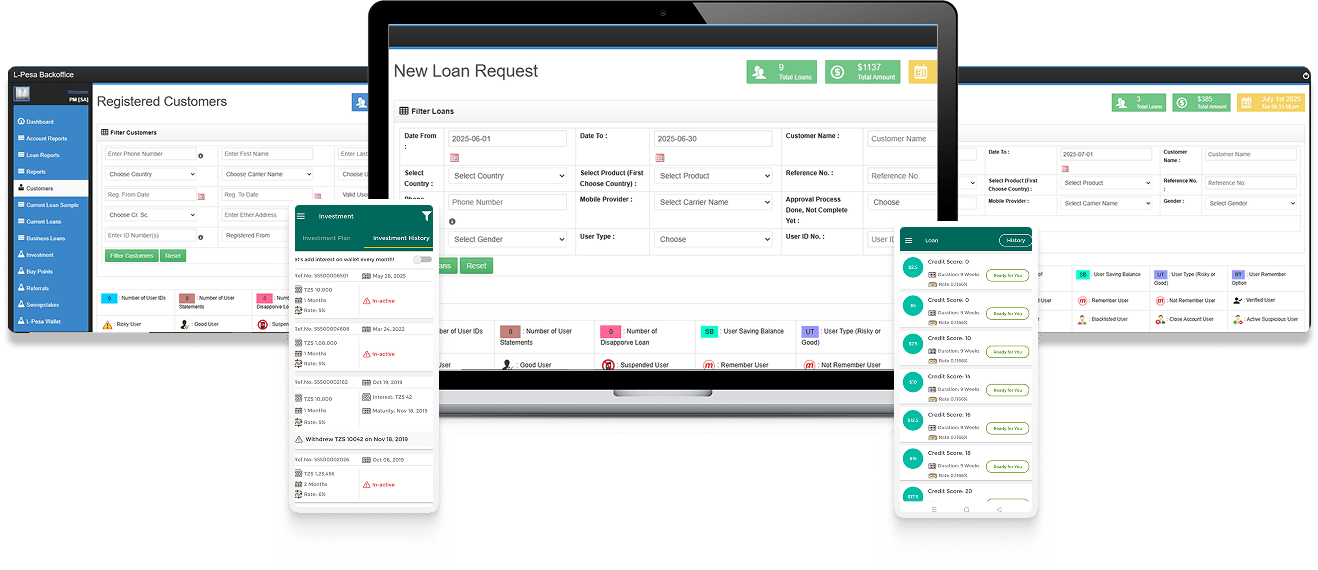

- Progressive Identity Verification Models.

- Smart User Segmentation.

- User Adoption via Mobile-First Channels.

A tiered KYC model was adopted, evolving from basic onboarding to credit-based verification involving ID cards and bank statements, especially critical in reducing early defaults.

Next, we tried our hands on a structured approach to user eligibility using contact info, credit score triggers, and bank data, allowing only qualifying users to move beyond entry-level loans.

Finally, USSD-based access, combined with multilingual app versions and responsive design, ensured usability even among low-tech populations in rural and semi-urban areas.